Australian Dollar maintains position as traders expect RBA to remain hawkish

11 Nov 2024

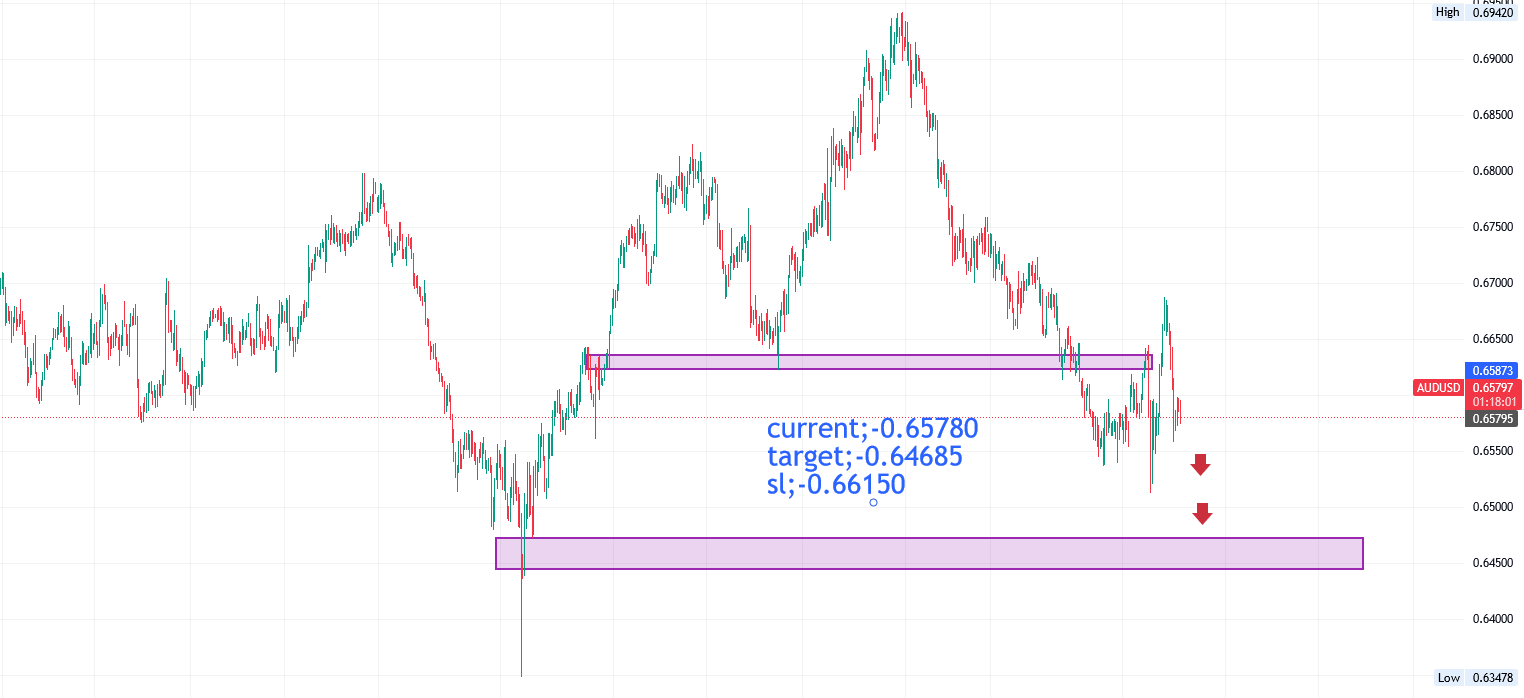

current;-0.65780

target;-0.64685

sl;-0.66150

The Australian Dollar may weaken in response to apprehensions regarding Donald Trump's tariffs on Chinese imports.

Additionally, the recent stimulus initiatives from China have not met the expectations of investors, further complicating the situation for the Aussie Dollar.

Furthermore, Trump's economic policies could increase inflationary pressures, leading the Federal Reserve to uphold a restrictive monetary policy.

The Australian Dollar (AUD) experienced a slight increase against the US Dollar (USD) on Monday, despite an overall pessimistic outlook influenced by worries regarding Donald Trump’s suggested tariff hikes on Chinese imports, which may affect Australian markets, given that China is one of its primary trading partners. It is noteworthy that US markets will be closed in observance of the Veteran’s Day Bank Holiday.

The Australian Dollar faces challenges due to the release of Chinese Consumer Price Index (CPI) data on Saturday, which was lower than anticipated. Furthermore, the recent stimulus measures implemented by China did not meet investor expectations, thereby diminishing demand prospects for Australia’s largest trading partner and exerting downward pressure on the Australian Dollar.

China unveiled a debt package amounting to 10 trillion Yuan on Friday, aimed at easing the financial burdens faced by local governments and bolstering sluggish economic growth. Nevertheless, the initiative did not include any direct economic stimulus measures.

In Australia, the yield on 10-year government bonds fell to approximately 4.6%, mirroring a decrease in US bond yields following the Federal Reserve's anticipated 25 basis point interest rate reduction. Last week, the Reserve Bank of Australia (RBA) opted to maintain its interest rate at 4.35%, highlighting that underlying inflation remains excessively high and is not projected to reach the target until 2026.

In the Daily Digest Market Movers, the Australian Dollar is experiencing downward pressure due to concerns over tariffs associated with Trump’s policies. Minneapolis Fed President Neel Kashkari remarked on Sunday that the US economy has demonstrated significant resilience as the Fed continues its efforts to manage inflation. However, he cautioned that the Fed is not yet fully confident in achieving its goals. He emphasized the necessity for further evidence before contemplating another rate cut to ensure inflation returns to the 2% target.

Morgan Stanley has categorized the macroeconomic policies of the Trump administration into three primary areas: tariffs, immigration, and fiscal measures. The report anticipates that tariff policies will take precedence, with an expected immediate implementation of 10% tariffs globally and 60% tariffs specifically targeting China. Analysts indicate that if Trump’s fiscal policies are enacted, they could result in increased investment, spending, and labor demand, thereby heightening inflation risks. This scenario may compel the Fed to adopt a more restrictive monetary policy, potentially strengthening the US Dollar and exerting additional pressure on the AUD/USD exchange rate.

Federal Reserve Chair Jerome Powell indicated on Thursday that he does not foresee any influence from a potential return of Trump to the White House on the Fed's short-term policy decisions. "We do not engage in guessing, speculation, or assumptions regarding future government policy choices," Powell remarked following the bank's decision to reduce interest rates by 25 basis points, bringing them to a range of 4.50%-4.75%, as anticipated.

Powell further asserted that the Federal Reserve will persist in evaluating economic data to determine the "pace and destination" of forthcoming rate adjustments, noting that inflation has been steadily decreasing towards the Fed's target of 2%.

In China, the Consumer Price Index (CPI) experienced a year-over-year increase of 0.3% in October, which was slightly below market forecasts and a decrease from September's 0.4%. This marks the ninth consecutive month of consumer price inflation, yet it is the lowest rate observed since June. On a month-over-month basis, the CPI fell by 0.3%, a more significant decline than the anticipated 0.1% drop, following a stable reading in September.

On Friday, the preliminary University of Michigan Consumer Sentiment Index increased to 73.0 in November, rising from 70.5 in October and surpassing the market expectation of 71.0.

According to a report from the US Department of Labor (DoL) on Thursday, initial jobless claims in the United States rose to 221,000 for the week ending November 1. This figure matched initial estimates and represented an increase from the previous week's revised total of 218,000, which was originally reported as 216,000.

Technical Analysis: Australian Dollar trades below 0.6600, nine-day EMA

The AUD/USD pair trades around 0.6590 on Monday. Daily chart indicated short-term downward pressure as the pair is positioned below the nine-day Exponential Moving Average (EMA). Additionally, the 14-day Relative Strength Index (RSI) has broken below the 50 mark, further suggesting that a bearish sentiment is prevailing.

In terms of support, the AUD/USD pair may approach its three-month low at 0.6512, which was recorded on November 6, followed by key psychological support at 0.6500.

On the upside, the immediate resistance appears at the nine-day EMA at 0.6604, followed by the 14-day EMA at 0.6616. A breakthrough above these EMAs could leadto revisit its recent high at 0.6687 level, followed by the psychological level of 0.6700.