EUR/JPY Price Forecast: Further consolidation cannot be ruled out below 164.50

15 Nov 2024

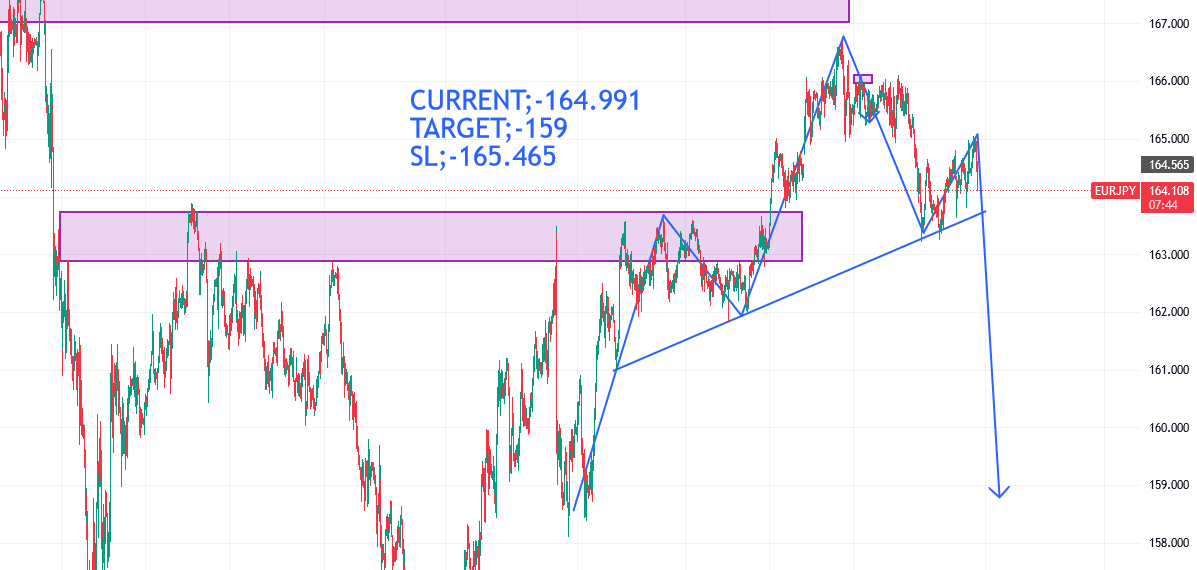

CURRENT;-164.991

TARGET;-159

SL;-165.465

EUR/JPY has risen slightly, approaching 164.40 during the early European trading session on Thursday.

Additional consolidation remains a possibility, given the neutral position of the RSI indicator.

The primary resistance level is identified in the range of 164.95 to 165.00, while the initial support level is situated at 163.64.

The EUR/JPY currency pair is experiencing upward momentum, reaching approximately 164.40 during the early hours of trading in Europe on Thursday. The Japanese Yen (JPY) is under pressure against the Euro (EUR) due to uncertainty surrounding the timing of a potential interest rate increase from the Bank of Japan (BoJ).

Market participants are preparing for the release of the flash Gross Domestic Product (GDP) figures for the Eurozone for the third quarter (Q3), which will be announced later on Thursday, alongside a speech from Christine Lagarde, President of the European Central Bank (ECB).

From a technical perspective, the EUR/JPY is positioned around the significant 100-period Exponential Moving Averages (EMA) within a descending trend channel on the 4-hour chart. A breakout above the 100-period EMA could signal a continuation of the upward trend. However, the possibility of further consolidation remains, as the Relative Strength Index (RSI) is situated near the midpoint, indicating a neutral momentum for the pair.

The key resistance level for EUR/JPY is identified in the range of 164.95 to 165.00, which marks both the upper boundary of the descending trend channel and a psychological threshold. Should buying pressure persist, a rise to 166.00, the peak recorded on November 7, may occur.

Conversely, the low of November 13 at 163.64 serves as initial support for the pair. A decisive move below this level could lead to a decline towards 162.90, the lower boundary of the trend channel. Further losses could potentially extend to 162.00, which represents the low from October 21 and a significant round number.