Gold Weekly Forecast: XAU/USD corrects lower after setting new record-high

26 Oct 2024

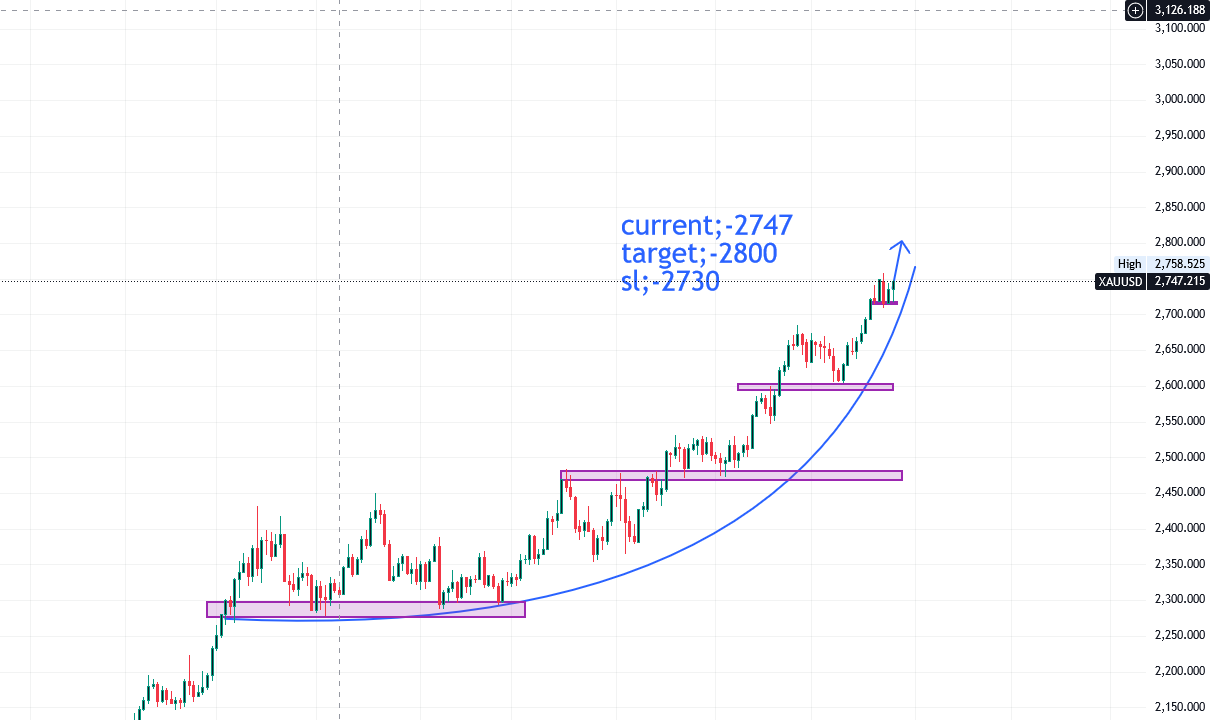

current;-2747

target;-2800

sl;-2730

overview

Gold investors gear up for key data releases

The US Bureau of Economic (BEA) will publish the first estimate of the annualized Gross Domestic Product (GDP) growth for the third quarter on Wednesday. Investors forecast the US GDP to expand by 3% in this period, matching the growth recorded in the second quarter. A reading above the market expectation could boost the USD as the immediate reaction and cause XAU/USD to stretch lower. On the other hand, a disappointing GDP print, between 1% and 2%, could hurt the USD.

On Thursday, the BEA will publish the Personal Consumption Expenditures (PCE) Price Index, the Federal Reserve’s (Fed) preferred gauge of inflation, for September. Because the GDP report will also offer quarterly PCE Price Index numbers, the monthly data is unlikely to trigger a market reaction.

Gold technical outlook

The Relative Strength Index (RSI) indicator on the daily chart retreated toward 60 after rising above 70 earlier in the week, suggesting that the bullish bias remains intact after Gold corrected its overbought conditions. Additionally, XAU/USD remains within the ascending regression channel coming from June.

Looking south, first support could be spotted at $2,700, where the mid-point of the ascending channel is located, before $2,675 (20-day Simple Moving Average) and $2,635 (lower limit of the ascending channel).

On the upside, interim resistance seems to have formed at $2,750 before $2,770 (upper limit of the ascending channel) and $2,800 (round level).