x

F

Y

I

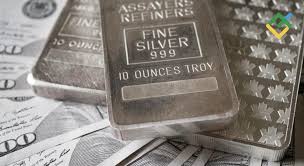

Silver Price Forecast: XAG/USD holds gains above $31.50 near two-month highs

04 Feb 2025

- Silver price appreciates as traders assess the potential impact of uncertain US trade policies on the global economy.

- The US tariffs on Mexican and Canadian goods have been postponed for at least 30 days after two days of implementation.

- The non-interest-bearing Silver receives support amid dovish signals from major central banks.

- Silver prices (XAG/USD) are experiencing a sustained upward trend, approaching two-month highs and trading at approximately $31.60 per troy ounce during the Asian trading session on Tuesday. Safe-haven assets, such as Silver, are gaining traction as market participants evaluate the potential ramifications of uncertain trade policies in the United States on the global economy.

On Monday, President Donald Trump announced a temporary halt to tariffs on Mexico and Canada following an agreement between their leaders to deploy 10,000 troops to the US border to address drug trafficking issues. The tariffs, which had been imposed just two days prior at a rate of 25% on goods from Mexico and Canada, have been deferred for a minimum of 30 days. In contrast, China remains the sole target of the new tariffs introduced by Trump, with the world's largest consumer of commodities facing a blanket tariff of 10% set to take effect at 05:00 GMT on Tuesday. - Silver, a non-yielding asset, continues to maintain its value in light of accommodating signals from prominent central banks. The Bank of Canada (BoC) has concluded its quantitative tightening measures and has joined Sweden’s Riksbank in reducing interest rates. Recently, the European Central Bank (ECB) decreased its Deposit Facility Rate by 25 basis points (bps) to 2.75%, while both the Reserve Bank of India (RBI) and the People’s Bank of China (PBoC) have suggested potential rate reductions in the near future. Additionally, markets are forecasting two rate cuts from the US Federal Reserve (Fed) within this year.

Economic data released by the Institute for Supply Management (ISM) on Monday indicated that the US Manufacturing PMI increased to 50.9 in January, up from 49.3 in December, exceeding the anticipated figure of 49.8. This stronger-than-expected performance points to a resurgence in US manufacturing activity, bolstering Silver’s position as a vital industrial metal, especially in electrification technologies.

The Silver Institute has recently forecasted a fifth consecutive year of notable market deficits in silver supply for 2025, driven by robust industrial demand and retail investment. These elements are anticipated to surpass the decline in consumption within the jewelry and silverware sectors.