x

F

Y

I

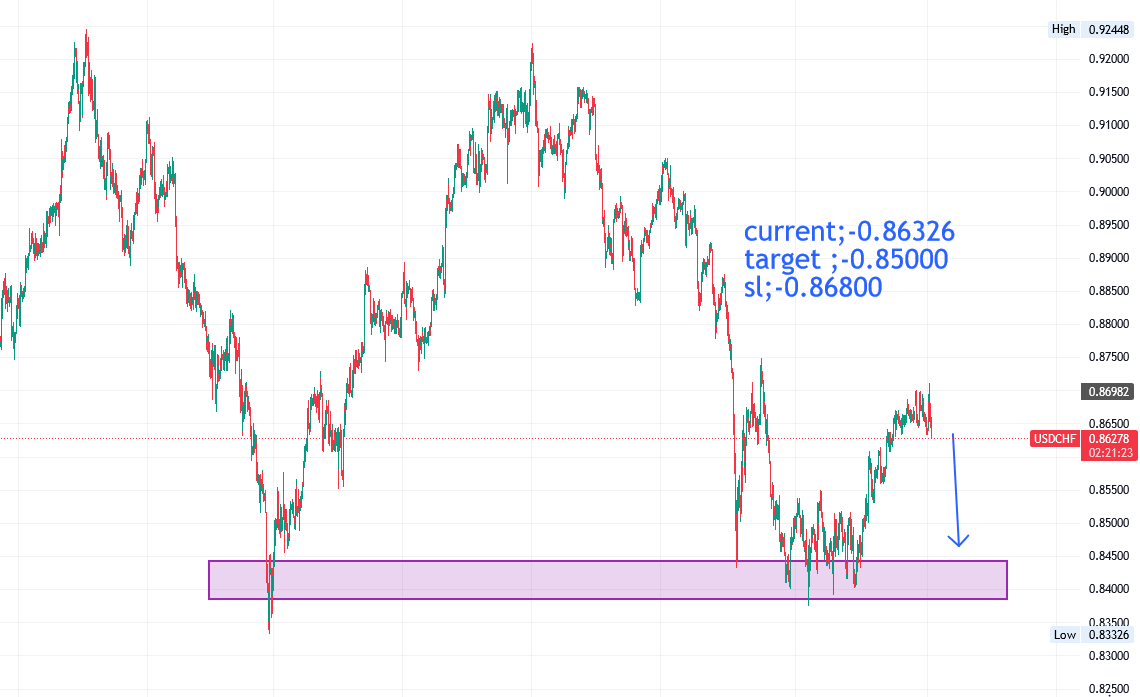

USD/CHF dips toward 0.8500 as the US Dollar weakens amid lower Treasury yields

04 Nov 2024

current;-0.86326

target ;-0.85000

sl;-0.86800

- The USD/CHF pair declines as the US Dollar weakens in response to decreasing Treasury yields.

- A recent survey shows that Kamala Harris and Donald Trump are in a tight race in seven key battleground states.

- Meanwhile, the yield on 10-year Swiss bonds is approaching 0.38%, driven by increasing anticipation of more substantial rate cuts from the Swiss National Bank.

The US Bureau of Labor Statistics (BLS) reported that Nonfarm Payrolls in October rose by just 12,000, a significant decrease from the revised September increase of 223,000 (originally reported as 254,000), and falling short of the anticipated 113,000. The Unemployment Rate held steady at 4.1% in October, aligning with market expectations.

Traders are keenly observing the upcoming US presidential election on Tuesday, as the latest New York Times/Siena College poll indicates a tight race between Democratic candidate Kamala Harris and Republican nominee Donald Trump across seven key battleground states. Attention will soon turn to the US Federal Reserve's policy decision, with a modest 25 basis point rate cut anticipated later this week.

In Switzerland, the yield on the 10-year government bond fell to approximately 0.38%, its lowest since early October, amid growing expectations for more significant rate cuts from the Swiss National Bank (SNB). This development follows a continued decline in inflation, with the Consumer Price Index (CPI) decreasing by 0.6% year-over-year in October, which was below the 0.8% forecast and represents the slowest growth rate since July 2021.

Swiss inflation has remained unchanged since April, and the October figure significantly underperformed the SNB’s fourth-quarter inflation target of 1%. This situation increases the likelihood that the SNB may contemplate a more substantial rate cut in December to maintain inflation within its target range of 0-2%, reflecting concerns about potential economic weakening.