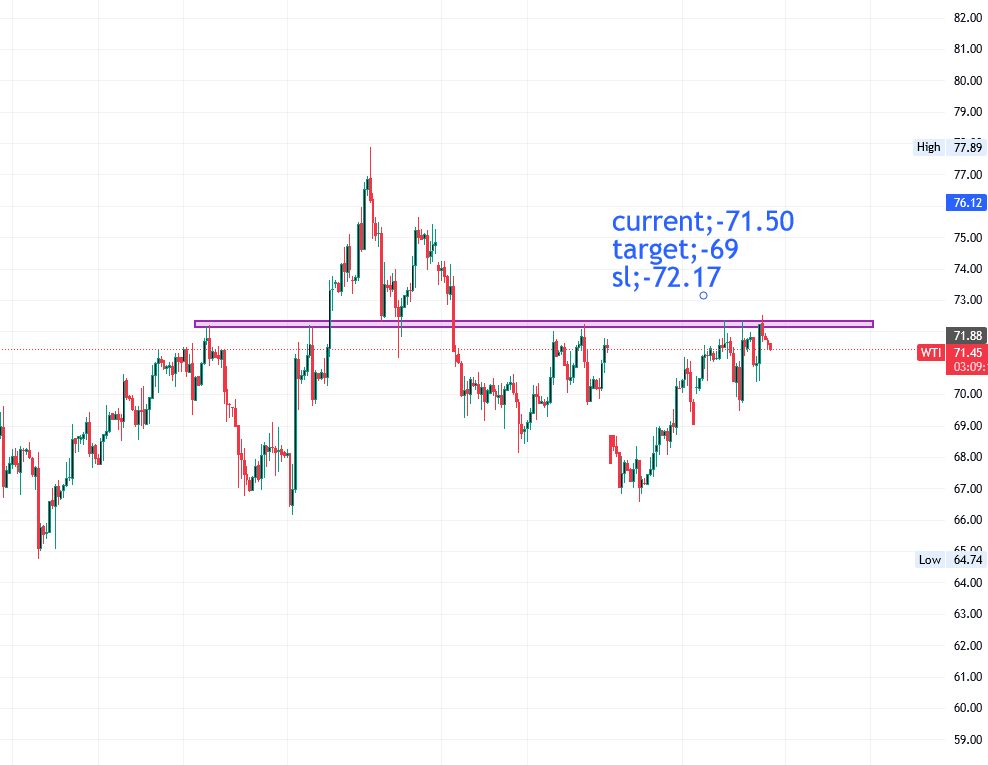

WTI hovers around $71.50, on course for a weekly gain of over 3%

08 Nov 2024

WTI prices are poised for a weekly increase exceeding 3% following the Federal Reserve's decision to lower interest rates.

Market participants anticipate that the forthcoming Trump administration will impose stricter sanctions on Iran and Venezuela, which could lead to a decrease in oil supply.

Additionally, crude oil supply disruptions persist as production in the U.S. Gulf of Mexico remains halted due to Hurricane Rafael.

West Texas Intermediate (WTI) crude oil prices have stabilized at approximately $71.50 per barrel during the Asian trading session on Friday, indicating a potential weekly increase exceeding 3%. This uptick in oil prices can be linked to investors evaluating the possible effects of the Federal Reserve's recent interest rate reduction and the forthcoming policies of the Donald Trump administration on oil supply dynamics.

During its November meeting on Thursday, the Federal Open Market Committee (FOMC) reduced its benchmark overnight borrowing rate by 25 basis points (bps), establishing a target range of 4.50%-4.75%. A decrease in oil prices could bolster economic activities in the United States, the world's largest oil consumer, and may have a favorable influence on oil demand.

Federal Reserve Chair Jerome Powell has announced that the central bank is moving forward with interest rate reductions, in light of the persistent tightness in monetary policy. He underscored that the Federal Reserve will continue to evaluate economic indicators to determine the "pace and destination" of forthcoming rate adjustments, noting that inflation is gradually approaching the Fed's target of 2%.

As reported by Reuters, Andrew Lipow, President of Lipow Oil Associates, remarked that oil prices have been supported by the anticipation that the incoming Trump administration may impose stricter sanctions on Iran and Venezuela, which could lead to a decrease in oil supply. "The market is now considering what Donald Trump's policies might entail, and it is responding to that expectation," Lipow commented.

Moreover, supply disruptions persist in the U.S. Gulf of Mexico due to Hurricane Rafael, prompting operators to reduce oil and gas production. The U.S. Bureau of Safety and Environmental Enforcement indicated on Thursday that more than 22% of crude oil production and 9% of natural gas output in the area were halted as a precautionary measure against the hurricane.

Conversely, oil prices may experience downward pressure due to reports showing a 9% decline in China's crude oil imports in October, marking the sixth consecutive month of year-on-year decreases. Nevertheless, investors remain optimistic about potential stimulus initiatives from China following the conclusion of the National People’s Congress Standing Committee's five-day meeting. Given that China is the largest oil importer globally, any favorable policies could significantly enhance demand for crude oil.