x

F

Y

I

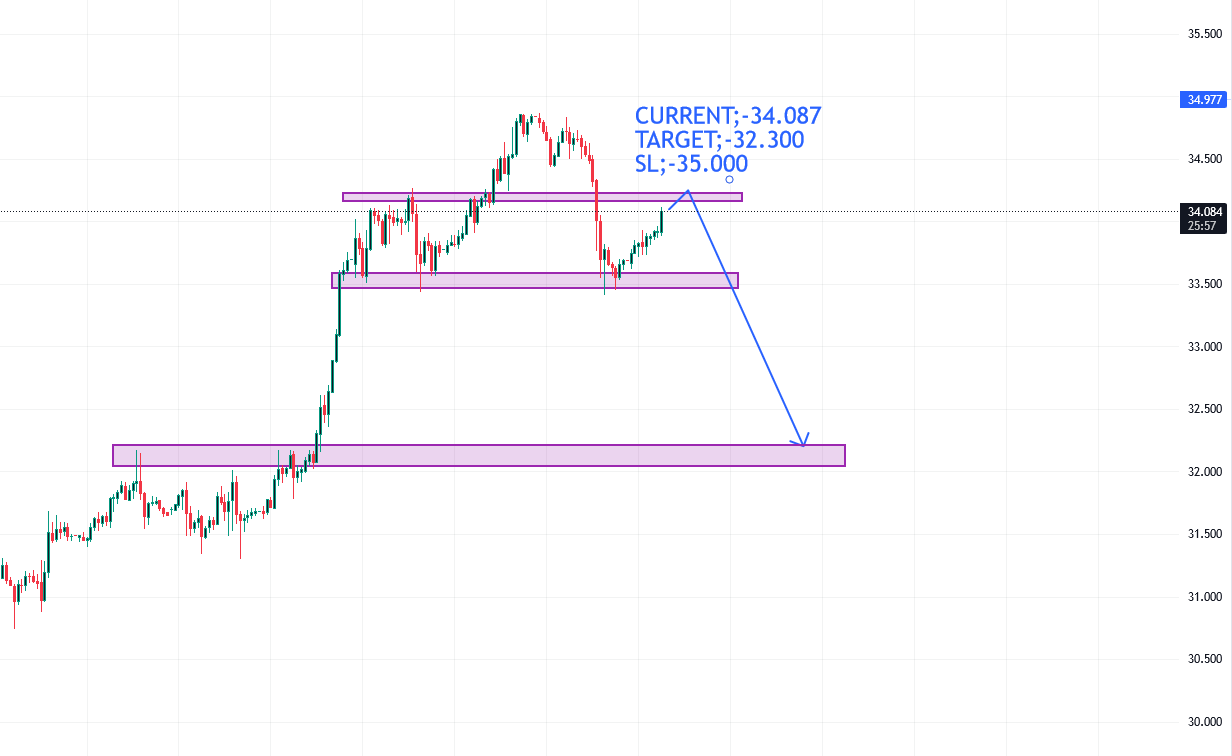

XAGUSD Silver Price Forecast: XAG/USD climbs closer to $34.00, remains below multi-year peak

24 Oct 2024

CURRENT;-34.087

TARGET;-32.300

SL;-35.000

- Silver has regained upward momentum after experiencing a pullback from a 12-year high

- To bolster the potential for further increases, a movement beyond the $34.25-$34.30 range is essential

- Any significant decline may entice dip-buyers, with support likely to be found around the $32.75-$32.65 levels.

OVERVIEW

- Silver (XAG/USD) has drawn interest from buyers during the Asian trading session on Thursday and appears to have halted its recent decline from the $34.85-$34.90 range, which represents the highest point reached since October 2012 earlier this week. The white metal is presently trading slightly below the $34.00 mark, reflecting an increase of more than 0.50% for the day

TECHNICAL

- It would be wise to await additional buying momentum and a consistent breakthrough of the $34.25-$34.30 resistance level before considering any further investments. Should the XAG/USD achieve this, it may gain positive traction and make a renewed effort to surpass the $35.00 psychological threshold. This upward momentum could potentially continue, propelling the commodity towards the swing high from October 2012, situated in the $35.35-$35.40 range.

- Conversely, the $33.45-$33.40 zone, which represents the weekly low recorded on Wednesday, may serve as a safeguard against immediate declines, particularly ahead of the $33.00 round number. Any additional drop is expected to entice dip-buyers, which would likely mitigate losses for the XAG/USD near the $32.75-$32.65 level, where resistance may transform into support. However, if there is significant follow-through selling, it could alter the market sentiment in favor of bearish traders, potentially leading to further declines.