x

F

Y

I

XAUUSD Gold price builds on steady intraday ascent, moves closer to $2,730 amid modest USD pullback

24 Oct 2024

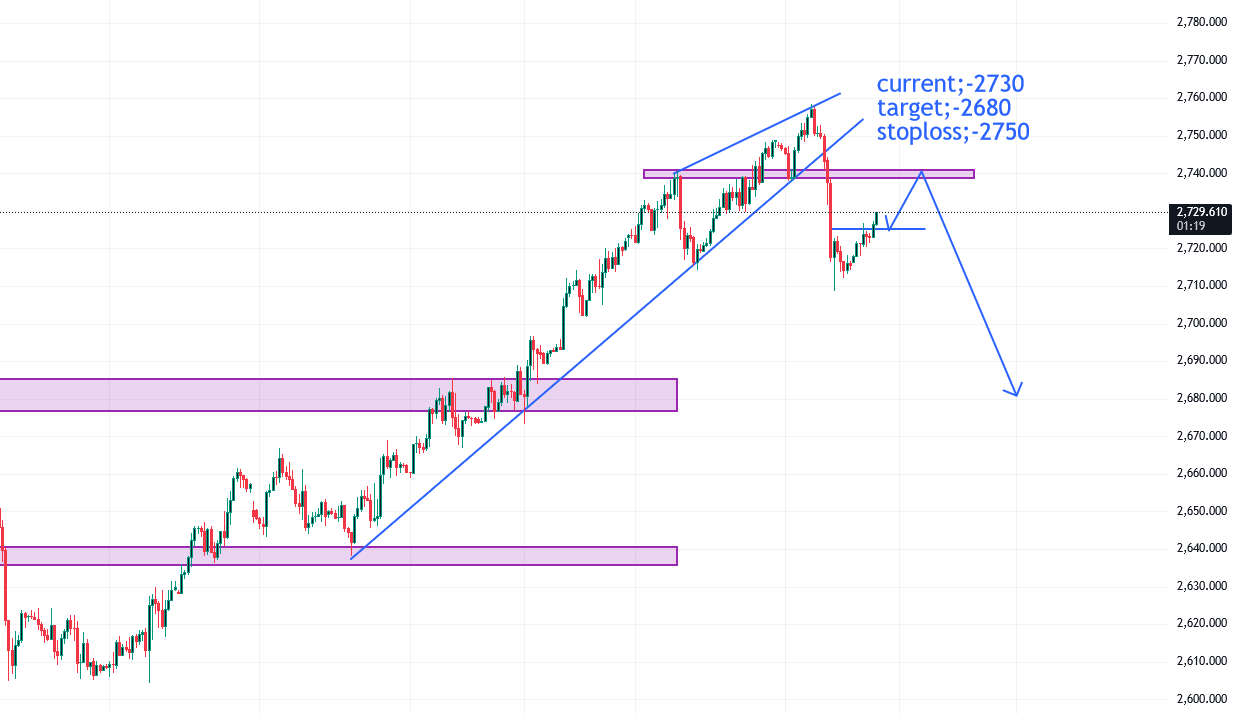

current;-2730

target;-2680

stoploss;-2750

- Gold has regained upward momentum, partially recovering from the decline experienced the previous day.

- The decrease in US bond yields has led to some profit-taking in the US dollar, which in turn supports the XAU/USD pair

- Additionally, ongoing geopolitical tensions and uncertainties surrounding US politics are influencing the intraday increase.

OVERVIEW

- Gold prices (XAU/USD) are experiencing a resurgence in demand during the Asian trading session on Thursday, halting the previous decline from a recent all-time high. The prevailing political uncertainty in the United States as the November 5 Presidential election approaches, along with ongoing tensions in the Middle East, are significant factors contributing to the sustained interest in this safe-haven asset. Additionally, the decline in US Treasury bond yields has led to profit-taking in the US Dollar (USD), further bolstering support for the non-yielding yellow metal.

- The potential for modest interest rate reductions by the Federal Reserve, coupled with concerns regarding deficit spending following the US election, is likely to restrict any significant decline in US bond yields. This scenario is advantageous for USD bulls, suggesting that caution is warranted before initiating new bullish positions on Gold and anticipating a continuation of the recent upward trend. Traders are now awaiting the release of the flash PMIs to gain new insights into the state of the global economy and to seek additional momentum.

Technical Outlook: Gold price could attract sellers near $2,730-2,732 region, ascending channel support breakpoint

- From a technical standpoint, the overnight decline beneath a short-term ascending trend-channel support may serve as a new catalyst for bearish traders. Additionally, the negative oscillators observed on hourly charts indicate that the most likely direction for Gold prices is downward. However, it remains wise to await a definitive breach below the $2,700 level before taking positions for any additional losses. Should this occur, the XAU/USD could potentially intensify its corrective decline towards the intermediate support at $2,685, on its way to the robust horizontal resistance zone between $2,672 and $2,670.

- Conversely, the support level of the ascending channel, located in the vicinity of $2,730 to $2,732, now appears to serve as a significant obstacle. The subsequent key resistance is identified near the $2,750 range, and if the Gold price surpasses this threshold, it may continue its established upward trajectory, potentially advancing towards the $2,770 to $2,775 area before targeting the $2,800 milestone.